Market Overview:

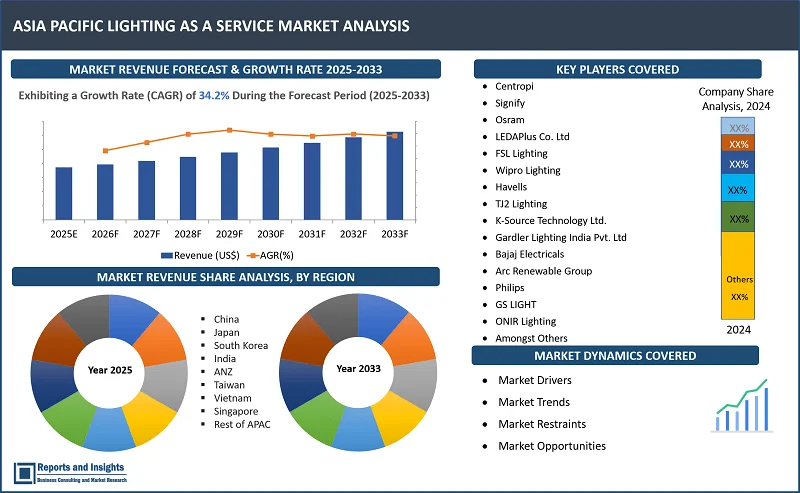

"The Asia Pacific lighting as a service market was valued at US$ 252.7 Million in 2024 and is expected to register a CAGR of 34.2% over the forecast period and reach US$ 3,567.6 Million in 2033."

|

Report Attributes |

Details |

|

Base Year |

2024 |

|

Forecast Years |

2025-2033 |

|

Historical Years |

2022-2024 |

|

Asia Pacific Lighting as a Service Market Growth Rate (2025-2033) |

34.2% |

Lighting As A Service (LaaS) is a business model wherein lighting facilities are offered to customers on a subscription basis or a pay-as-you-go basis, as opposed to customers purchasing and maintaining the lighting infrastructure themselves. This service is rendered in commercial, industrial, and municipal environments of energy-efficient lighting systems, including design, installation, operation, and maintenance. Beyond this, services include smart controls, energy monitoring, and automation. Keeping in view, LaaS supports sustainability goals by promoting longer-lasting and lower-emission technology, usually bundled with data analytics to ensure energy optimization. Furthermore, there is an increase in demand from organizations for the LaaS model to fulfill ESG goals and reduce energy costs for energy use without the burden of ownership.

In the Asia Pacific region, Lighting as a Service (LaaS) is registering significant growth due to increasing urbanization, energy efficiency regulations, and demand for smart and sustainable infrastructure. High government incentives and growing energy conservation awareness in countries of China, India, Japan, and Australia contribute to the market growth. Moreover, major players partner with tech solutions providers for offering tailor-made solutions based on local requirements. They offer scalable solutions that are flexible and green for a wide range of applications.

Asia Pacific Lighting as a Service Market Trends and Drivers

Innovations in LED lighting, smart lighting systems, and IoT integration drive the growth of the Asia Pacific lighting as a service market. The integration of smart lighting controls and sensors within LaaS solutions allows lights to be adjusted on their own for occupancy, daylight, and energy consumption which increases efficiency and further cuts down on costs. Also, real-time monitoring and management of lighting systems can be implemented with the use of IoT platforms, thereby offering the service providers with sufficient data for optimizing performance and potentially fixing maintenance issues upfront.

The increasing sustainability and environmental concerns of the region also facilitate the growing trend in markets. Governments and industry-wide initiatives become important in where of footprint and carbon consumption being positively reduced. Cloud-based control systems and IoT offer more than environmental and cost reduction benefits; energy savings, and environmental benefits which can be obtained from real-time visibility, and adaptability of light and use (LaaS). Moreover, with ESG (Environmental, Social, and Governance) measures increasingly becoming part of companies' corporate strategy, LaaS is an equally adaptable and sustainable choice that adds many economic benefits.

Asia Pacific Lighting as a Service Market Restraining Factors

One of the significant restraining factors to the development of the Asia Pacific Lighting as a Service (LaaS) market is the high cost and financial structures that require for advanced lighting technologies such as smart sensor and LED infrastructure. Also, the payment arrangements such as performance-based payments or leasing can become complex and difficult for end users to digest. These financial structures can lack transparency and require detailed long-term cost / benefit analysis which can deter potential adopters that are unfamiliar with these service type arrangements.

Another limiting factor for the growth of the LaaS market is its adoption, especially in developing countries, further limited by a lack of appropriate infrastructure. Many of these areas lack a reliable power supply, functioning distribution grids, and systems that has sufficient internet connection, all of which are necessary for implementing state-of-the-art, cloud-based LaaS solutions. in addition, the lack of technical skill or capacity, and limited funding local governments and businesses to meet the requirements of a LaaS ecosystem, contribute to a serious limiting factor of LaaS market growth.

Asia Pacific Lighting as a Service Market Player Opportunities

Companies can partner with smart city developers, energy service companies (ESCOs) and IoT technology developers to offer connected and integrated lighting. These collaborations allow both parties to access greater analytics, monitoring and even maintenance services, thereby optimizing value provided to customers. In addition, partnerships between lighting manufacturers and telecom/cloud service providers also help with the integration of connected lighting systems in smart infrastructure. Even governments and utilities are partnering with private players to increase LaaS implementation across public spaces, streets and commercial buildings.

Asia Pacific Lighting as a Service Market Segmentation

By Service Type

- Design and Consulting

- Installation and Integration

- Maintenance and Operation

- Managed Services

- Energy Optimization

- Others

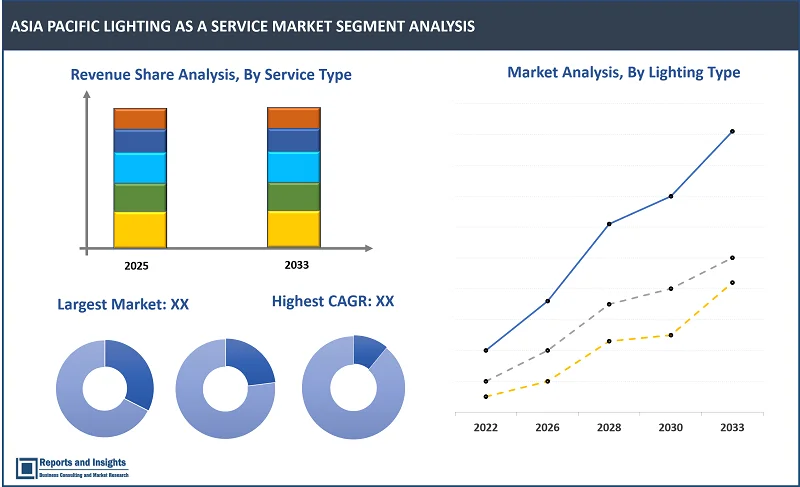

Thе installation and integration sеgmеnt among the service type sеgmеnt is еxpеctеd to account for thе largеst rеvеnuе sharе in thе Asia Pacific lighting as a service markеt. This dominancе can bе attributеd to the increase in urbanization, smart city programs, and the verified commitment to energy-efficient infrastructure in that region. Countries like China, India and Southeast Asian countries are aggressively replacing their public and private lighting systems to LED and IoT-based systems that require expert installation, and systems integration.

By Lighting Type

- LED Lighting

- Fluorescent Lighting

- High-Intensity Discharge (HID) Lighting

- Incandescent Lighting

- Others (CFL, Halogen, etc.)

Thе LED lighting sеgmеnt among thе lighting type sеgmеnt is еxpеctеd to account for thе largеst rеvеnuе sharе in thе Asia Pacific lighting as a service markеt. This dominancе can bе attributеd to LEDs’ grеatеr еnеrgy еfficiеncy, longеr opеrating lifе, and lower costs from traditional lighting tеchnologiеs such as incandescent or fluorеscent lights. In addition, nеw smart lighting systеms utilizing IoT and AI tеchnologiеs are primarily built on top of LED infrastructures, contributing to the same dominancе.

By Component

- Luminaries and Fixtures

- Lighting Controls

- Sensors

- Dimmers

- Daylight Harvesting

- Smart Lighting Systems

- Softwares and Communication Systems

- Software

- Lighting Management Software

- Energy Monitoring Software

- Services

- Installation Services

- Maintenance Services

Among the component segments, the luminaries and fixtures segment is expected to account for the largest revenue share. This dominance can be due to the addition of IoT and AI into luminaries and fixtures, allowing these devices to provide better functionality and look even better in urban settings.

By Installation

- Retrofit Installation

- New Installation

Among the installation segments, the retrofit installation segment is expected to account for the largest revenue share. This dominance can be attributed to the urbanization in the region and the need to upgrade existing infrastructure to meet modern energy efficiency standards. Offering a cost-effective approach and eliminate the need for significant upfront capital expenditure by adopting an operational expenditure (OPEX) model which can be an attractive option for organizations looking to minimize overall energy consumption and operational expenses.

By End Use

- Commercial

- Industrial

- Municipal/Public

- Residential

- Hospitals & Clinics

- Schools & Universities

- Hotels & Restaurants

- Transportation

- Others

Among the end-use segments, the commercial segment is expected to account for the largest revenue share. The dominance is due to the rapid growth in demand for affordable and energy-efficient lighting solutions in offices, retail, hospitality, and public infrastructure. Companies are now employing service-based models which enable them to mitigate upfront capital costs while also reducing the ongoing maintenance costs associated with traditional lighting systems.

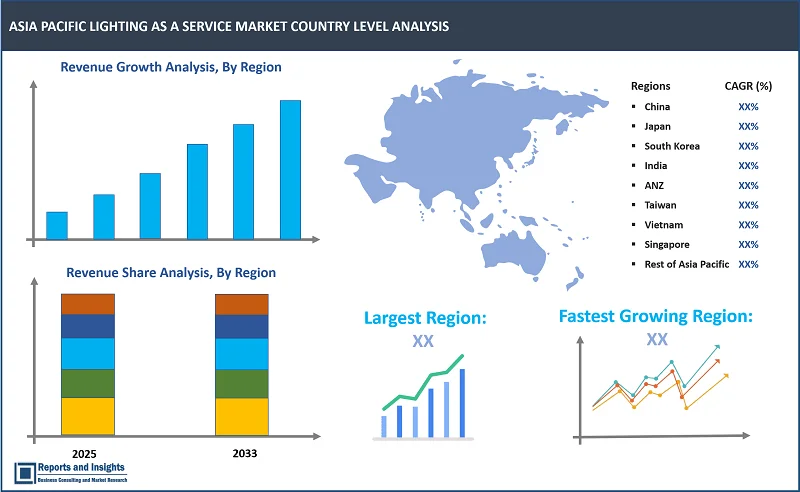

By Country

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Taiwan

- Vietnam

- Singapore

- Rest of Asia Pacific

In Asia Pacific lighting as a service market, countriеs likе China, Japan, and South Korеa arе at thе forеfront of tеchnology adoption. In China, initiatives to promote smart cities and energy efficiency and carbon reduction policies drive the adoption of LaaS which include large retrofitting of LEDs and solid-state lighting projects as artificial intelligence is integrated in smart city development. India's strong market growth is driven by demand to modernize urban infrastructure and the objectives of the Smart City Mission. In Japan, a high level of integration of renewable energy sources with advanced energy management systems exists with a strong commitment by the government for sustainability. In addition, Singapore, Malaysia, and Thailand are adopting LaaS to improve energy efficiency as a part of modernization of their infrastructure. Furthermore, countries in the ASEAN region have well-advanced plans to develop a regional energy network through the ASEAN Power Grid initiative to provide new opportunities for LaaS projects to provide energy-efficient and sustainable lighting solutions.

Leading Companies in Asia Pacific Lighting as a Service Market & Competitive Landscape:

The competitive landscape in the Asia Pacific lighting as a service market is characterized by intense competition among leading manufacturers seeking to leverage maximum market share. Major companies are focused on innovation and differentiation and compete on factors such as product quality, technological advancements, and cost-effectiveness to meet the evolving demands of consumers across various sectors. Some key strategies adopted by leading companies include investing significantly in Research and Development (R&D) to design lighting as a service. In addition, companies focus on improving durability, energy efficiency, and properties of Asia Pacific lighting as a service, and maintain their market position by steady expansion of their consumer base. Companies also engage in strategic partnerships and collaborations with research firms and manufacturers, which allows them to integrate their Asia Pacific lighting as a service with different technology. Moreover, companies are emphasizing on sustainable practices by exploring eco-friendly materials and production processes to appeal to environmentally conscious consumers and align with sustainability goals.

These companies include:

- Centropi

- Signify

- Osram

- LEDAPlus Co. Ltd

- FSL Lighting

- Wipro Lighting

- Havells

- TJ2 Lighting

- K-Source Technology Ltd.

- Gardler Lighting India Pvt. Ltd

- Bajaj Electricals

- Arc Renewable Group

- Philips

- GS LIGHT

- ONIR Lighting

- MaxLite

Recent Developments:

- May 2025: Dixon Technologies and Signify collaobrated in India for manufacturing lighting products and accessories, enhancing the ‘Make in India’ and 'Atmanirbhar Bharat' initiatives. This partnership aims to leverage Signify's lighting technology expertise.

- April 2025: Valeo, the world leader in automotive lighting systems and software, together with Appotronics, inventor of ALPD laser display technology announced a strategic partnership to offer a new generation of automotive front lighting solutions integrating exclusive Appotronics’ ALL-in-ONE full-color laser headlight system. Valeo bring its unique expertise in lighting systems design and electronic control units design, along with unrivaled software capabilities, to integrate Appotronics recognized knowledge in projection systems design based on laser display technologies into new generation front lighting solutions.

- March 2025: Signify, the world leader in lighting, and Dixon Technologies (India) Ltd. announced the intent to form a joint venture to enhance manufacturing excellence in India. The proposed joint venture, pending required regulatory approvals, and produce lighting products and accessories for leading brands in the highly competitive Indian market.

- March 2024: MaxLite, a pioneer in energy-efficient lighting solutions announced the launch of c-Max Network Partners, featuring advanced network lighting controls proposition that seamlessly combines MaxLite’s broad c-Max controls ready luminaires with other industry-leading technology partners control systems.

Asia Pacific Lighting as a Service Market Research Scope

|

Report Metric |

Report Details |

|

Asia Pacific Lighting as a Service Market size available for the years |

2021-2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2033 |

|

Compound Annual Growth Rate (CAGR) |

34.2% |

|

Segment covered |

By Service Type, Lighting Type, Component, Installation, and End Use |

|

Regions Covered |

China, Japan, South Korea, India, Australia & New Zealand, Taiwan, Vietnam, Singapore, & Rest of Asia Pacific |

|

Fastest Growing Country in Asia Pacific |

India |

|

Largest Market |

China |

|

Key Players |

Centropi, Signify, Osram, LEDAPlus Co. Ltd, FSL Lighting, Wipro Lighting, Havells, TJ2 Lighting, K-Source Technology Ltd., Gardler Lighting India Pvt. Ltd, Bajaj Electricals, Arc Renewable Group, Philips, GS LIGHT, ONIR Lighting, MaxLite |

Frequently Asked Question

What is the size of the Asia Pacific lighting as a service market in 2024?

The Asia Pacific lighting as a service market size reached US$ 252.7 million in 2024.

At what CAGR will the Asia Pacific lighting as a service market expand?

The Asia Pacific lighting as a service market is expected to register a 34.2% CAGR through 2025-2033.

How big can the Asia Pacific lighting as a service market be by 2033?

The market is estimated to reach US$ 3,567.6 Million by 2033.

What are some key factors driving revenue growth of the Asia Pacific lighting as a service market?

Key factors driving revenue growth in the Asia Pacific lighting as a service market includes smart city initiatives, technological innovation, enhanced customer experience, and others.

What are some major challenges faced by companies in the Asia Pacific lighting as a service market?

Companies in the Asia Pacific lighting as a service market face challenges such as cybersecurity risks, cost management, regulatory compliance, and others.

How is the competitive landscape in the Asia Pacific lighting as a service market?

The competitive landscape in the Asia Pacific lighting as a service market is marked by intense rivalry among leading manufacturers. Companies compete on product quality, innovation, and cost-effectiveness. To maintain their market position, leading firms invest in research and development, form strategic partnerships, and explore sustainable practices to differentiate themselves and meet evolving consumer demands.

How is the Asia Pacific lighting as a service market report segmented?

The Asia Pacific lighting as a service market report segmentation is based on service type, lighting type, component, installation, and end use.

Who are the key players in the Asia Pacific lighting as a service market report?

Key players in the Asia Pacific lighting as a service market report include Centropi, Signify, Osram, LEDAPlus Co. Ltd, FSL Lighting, Wipro Lighting, Havells, TJ2 Lighting, K-Source Technology Ltd., Gardler Lighting India Pvt. Ltd, Bajaj Electricals, Arc Renewable Group, Philips, GS LIGHT, ONIR Lighting, MaxLite.