Market Overview:

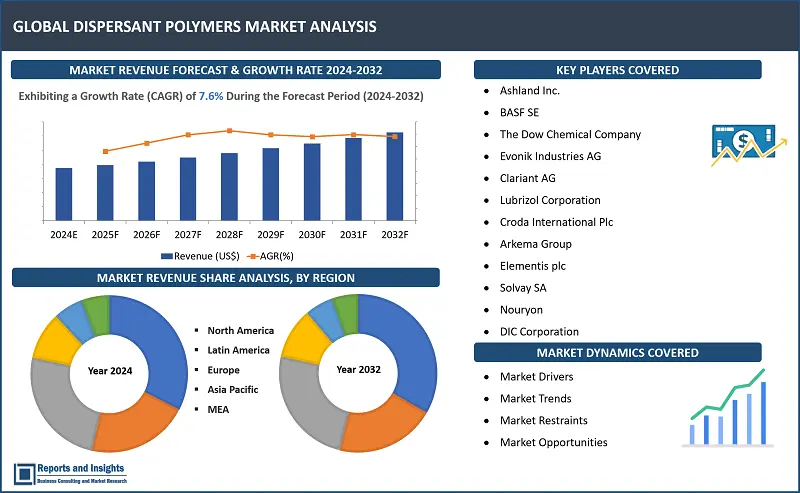

"The global dispersant polymers market size reached US$ 7.3 billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 14.1 billion in 2032, exhibiting a growth rate (CAGR) of 7.6% during 2024-2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

7.6% |

Dispersant polymers are specialized additives widely used in industries such as paints, coatings, and personal care products. These substances offer remarkable benefits by enhancing the dispersion of solid particles within liquid formulations, preventing clumping or settling. This leads to improved stability, viscosity control, and better product performance. In the market, various types of dispersant polymers cater to diverse applications. Anionic dispersants are commonly used for pigments and inorganic materials, while cationic dispersants find utility in personal care items. Nonionic dispersants offer versatility across industries. The ability of these polymers to optimize particle distribution makes dispersant polymers vital tools for achieving consistent and high-quality formulations.

The global dispersant polymers market is registering steady revenue growth due to increasing demand across sectors such as coatings, chemicals, and pharmaceuticals. Increasing industrialization and urbanization drive consumption and market revenue growth. These polymers offer improved dispersion, stability, and rheology control. Advancements in polymer chemistry have led to tailor-made solutions for specific applications. Initiatives for sustainable and eco-friendly products further support revenue growth of the global market. Advantages include enhanced product quality and reduced wastage. In-depth analysis and insights reveal evolving market trends, regional variations, and competitive landscapes, aiding businesses in strategic decision-making and staying ahead in this dynamic industry.

Dispersant Polymers Market Trends and Drivers:

Rising Industrialization: Increasing industrial activities in sectors such as paints, coatings, and adhesives drive demand for dispersant polymers to improve product quality and performance, directly contributing to market revenue growth.

Technological Advancements: Ongoing research and development in polymer chemistry are leading to innovative dispersant solutions tailored to specific applications, attracting customers seeking superior dispersion and stability, thus boosting market revenue growth.

Sustainability Initiatives: As environmental concerns grow, the shift towards eco-friendly and biodegradable dispersant polymers aligns with consumer preferences, enhancing revenue by catering to responsible consumption.

Global Urbanization: Urbanization drives demand for construction materials, coatings, and personal care products, supporting the need for effective dispersant polymers, positively impacting market revenue growth.

Increased Infrastructure Investment: Infrastructure projects worldwide necessitate high-performance coatings and concrete admixtures, driving adoption of dispersant polymers and consequently, revenue expansion.

Increasing Consumer Awareness: As end users become more informed about the benefits of dispersant polymers in various products, manufacturers can capitalize on this awareness to offer improved formulations, generating increased sales and revenue.

Dispersant Polymers Market Restraining Factors:

Raw Material Price Volatility: Fluctuations in the prices of key raw materials used in dispersant polymer production can lead to increased production costs, squeezing profit margins and hampering market revenue growth.

Regulatory Constraints: Stringent environmental regulations and standards regarding the use of certain chemicals in dispersant polymers may limit product development and market access, negatively impacting market revenue growth.

Substitution Threats: Emergence of alternative technologies or products that offer similar dispersion benefits could reduce demand for dispersant polymers, negatively affecting market revenue growth.

Slow Adoption Rates: Industries with well-established processes and formulations might be resistant to change, leading to slower adoption rates of dispersant polymers and subsequently restraining market revenue growth.

Economic Downturns: During economic downturns, industries such as construction and automotive, which heavily rely on dispersant polymer applications, might experience reduced demand, impacting overall revenue growth of the global market.

Dispersant Polymers Market Opportunities:

Diversification of Applications: Expanding into new industries such as textiles, agriculture, and pharmaceuticals presents opportunities to tap into previously untapped markets, opening up additional revenue streams.

Customized Solutions: Offering tailor-made dispersant polymers for specific client needs enables premium pricing and long-term partnerships, driving revenue growth through value-added services.

Green and Sustainable Solutions: Developing environmentally friendly and biodegradable dispersant polymers aligns with consumer preferences for sustainable products, attracting a wider customer base and enhancing revenue potential.

Product Innovation: Continuously investing in research and development to create novel dispersant polymers with improved performance characteristics can position companies as leaders, enabling premium pricing and dominance in the market.

Global Expansion: Penetrating emerging markets with increasing industrial sectors provides opportunities for increased demand and revenue growth, capitalizing on expanding manufacturing and construction activities.

Value Chain Integration: Companies can explore vertical integration by incorporating raw material production or downstream applications, streamlining operations, and capturing a larger portion of the value chain revenue.

Market Segmentation:

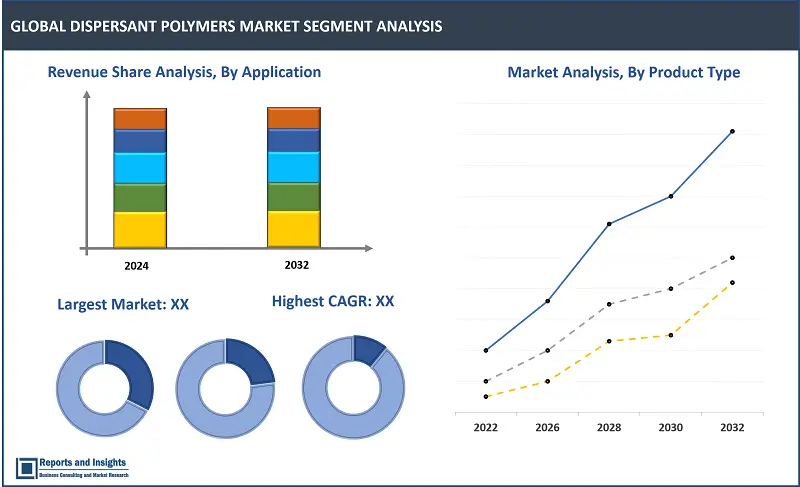

By Product Type:

- Anionic Dispersant Polymers

- Cationic Dispersant Polymers

- Nonionic Dispersant Polymers

By Application:

- Paints and Coatings

- Adhesives and Sealants

- Construction Materials

- Personal Care and Cosmetics

- Textiles

- Pharmaceuticals

- Others

By End-Use Industry:

- Automotive

- Building and Construction

- Oil and Gas

- Chemicals

- Agriculture

- Packaging

- Others

By Formulation:

- Water-Based

- Solvent-Based

- Powdered

- Emulsion

By Functionality:

- Stabilization

- Rheology Modification

- Viscosity Control

- Dispersion Enhancement

- Flocculation

- Binding

- Others

By Region:

- North America

- Latin America

- Asia Pacific

- Europe

- Middle East & Africa

The United States holds the largest market share in North America, due to a confluence of factors. Its diverse industrial landscape, encompassing sectors such as paints, coatings, adhesives, textiles, and oil and gas, generates a substantial and varied demand for these specialized additives. The country's robust research and development capabilities continuously drive innovation, resulting in tailored dispersant polymer formulations that cater precisely to the needs of different industries. Ongoing infrastructure projects contribute to consistent demand, particularly in construction-related applications, where dispersant polymers find extensive use in coatings and concrete admixtures. The US's commitment to stringent environmental regulations further drives demand for eco-friendly and sustainable dispersant solutions, aligning with the country’s emphasis on responsible practices. High consumer awareness regarding the advantages of dispersant polymers in enhancing product performance and stability contributes to the overall demand. The US's global economic influence and investment in research and advanced manufacturing techniques further cement its status as a leader in the dispersant polymer market, registering high demand and an environment conducive to continued growth in this sector.

In Europe, dispersant polymer sales are expected to be influenced by a range of key trends. The region's strong commitment to sustainability and stringent environmental regulations are expected to significantly boost demand, favoring adoption of eco-friendly and biodegradable dispersant polymers. In addition, the shift towards water-based systems in coatings, paints, and adhesives, driven by their lower Volatile Organic Compound (VOC) emissions, aligns well with the capabilities of dispersant polymers, driving product use in various applications.

Investments in China and India emerges as a pivotal driver for the global dispersant polymers market growth, underpinned by various factors. The robust economic expansion witnessed in both countries, coupled with rapid industrialization, drives demand for a diverse array of products that rely on dispersant polymers, spanning paints, coatings, adhesives, and construction materials. With colossal consumer bases, China and India become pivotal markets driving the need for dispersant polymers across various everyday items. As both nations heavily invest in expansive infrastructure projects spanning construction, transportation, and energy sectors, dispersant polymers gain indispensability in optimizing construction materials and coatings. These countries have solidified as manufacturing hubs, drawing global companies that require stable and high-performance formulations, thus driving demand for dispersant polymers.

Leading Dispersant Polymers Providers & Competitive Landscape:

The global dispersant polymers market features a competitive landscape characterized by a mix of established players and innovative newcomers striving to capture market share and meet diverse industry demands. Leading manufacturers play a pivotal role in determining the market dynamics, product innovations, and technological advancements. These companies leverage extensive experience, research capabilities, and widespread distribution networks to maintain their dominance and drive market revenue growth.

Prominent manufacturers in the global dispersant polymers market include Ashland Inc., BASF SE, The Dow Chemical Company, Evonik Industries AG, Clariant AG, and Lubrizol Corporation. These industry giants possess a strong global presence, offering a wide range of dispersant polymer solutions tailored for various industries such as paints, coatings, adhesives, construction, and personal care. Offerings by these companies cater to a diverse set of customer needs, ranging from stability enhancement and viscosity control to advanced formulation optimization.

The competitive landscape is also marked by innovation-driven companies that continuously strive to bring novel solutions to the market. These players focus on R&D to develop unique dispersant polymers with specialized functionalities, allowing them to carve out niche segments and challenge the market leaders. Collaborations with end users, research institutions, and industry associations enable them to stay at the forefront of technological advancements and customer preferences.

As demand for eco-friendly and sustainable products rises, manufacturers are investing in developing dispersant polymers that align with environmental standards and regulations. This shift emphasizes the need for manufacturers to adopt green practices, further enhancing market presence in the competitive landscape by addressing conscious consumer demands.

In this competitive arena, manufacturers are also concentrating on expanding market reach through strategic partnerships, acquisitions, and alliances. This approach not only helps them broaden product portfolios but also enhances their global footprint, enabling them to cater to diverse markets and industry verticals effectively.

Company List:

- Ashland Inc.

- BASF SE

- The Dow Chemical Company (now part of Dow Inc.)

- Evonik Industries AG

- Clariant AG

- Lubrizol Corporation (a subsidiary of Berkshire Hathaway)

- Croda International Plc

- Arkema Group

- Elementis plc

- Solvay SA

- Nouryon (formerly AkzoNobel Specialty Chemicals)

- DIC Corporation

- Wacker Chemie AG

- Huntsman Corporation

- PCC SE

Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

7.6% |

|

Segment covered |

Product Type, Application, End-Use Industry, Formulation, Functionality, and Regions |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Increasing Market in Europe |

Germany |

|

Largest Market in Asia Pacific |

China |

|

Key Players |

Ashland Inc., BASF SE, The Dow Chemical Company (now part of Dow Inc.), Evonik Industries AG, Clariant AG, Lubrizol Corporation (a subsidiary of Berkshire Hathaway), Croda International Plc, Arkema Group, Elementis plc, Solvay SA, Nouryon (formerly AkzoNobel Specialty Chemicals), DIC Corporation, Wacker Chemie AG, Huntsman Corporation, and PCC SE |

Frequently Asked Question

What are the key applications of dispersant polymers?

Dispersant polymers are extensively used in various industries, including paints and coatings, adhesives and sealants, construction materials, personal care products, textiles, pharmaceuticals, and more. These enhance stability, dispersion, and performance of products across these sectors.

What types of dispersant polymers are commonly used?

The market players offer different types of dispersant polymers, including anionic, cationic, and nonionic variants. Each type possesses specific properties and functionalities that cater to diverse formulation and application requirements.

How do dispersant polymers contribute to environmental sustainability?

Dispersant polymers manufacturers are increasingly focusing on developing eco-friendly and biodegradable formulations to align with global sustainability goals. These sustainable dispersants provide efficient performance while minimizing environmental impact.

Which end-use industries drive demand for dispersant polymers?

Dispersant polymers are crucial in industries such as automotive, building and construction, oil and gas, chemicals, agriculture, packaging, and more. These polymers enhance product quality, stability, and performance in diverse manufacturing processes.

What is the role of innovation in the dispersant polymers market?

Innovation plays a vital role in the dispersant polymers market, driving the development of novel formulations with enhanced functionalities. Collaborations, research investments, and technological advancements lead to customized solutions for specific applications, catering to evolving industry demands.