Market Overview:

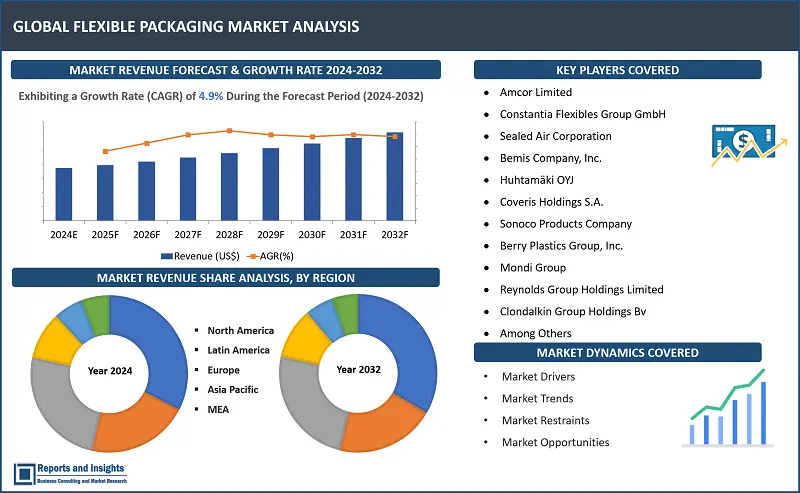

"The global flexible packaging market size reached US$ 261.1 billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 401.6 billion in 2032, exhibiting a growth rate (CAGR) of 4.9% during 2024-2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

4.9% |

Flexible packaging is a form of packaging made from materials like plastic, paper, or foil that can be easily shaped or formed. It's used for products needing protection against moisture, oxygen, and light. This type of packaging is versatile, coming in different shapes and sizes, and is suitable for various products such as food, beverages, pharmaceuticals, and personal care items. It's lightweight, cost-effective, and often more environmentally friendly than rigid packaging.

The global flexible packaging market is thriving, fueled by factors like growing demand for convenient packaging, shifts in consumer lifestyles, and the expansion of e-commerce. This type of packaging is favored for its lightweight properties, cost-effectiveness, and eco-friendliness compared to rigid packaging. The industry is marked by ongoing innovation, as companies work to create new materials and technologies that cater to changing consumer and industry demands.

Flexible Packaging Market Trends and Drivers:

The flexible packaging market is influenced by several key trends and drivers. One notable trend is the increasing demand for environmentally friendly packaging solutions, spurred by growing environmental awareness. Both consumers and regulatory bodies are advocating for packaging materials that can be recycled, reused, or composted. Another significant driver is the expansion of e-commerce, which has created a greater need for packaging that not only protects products but also enhances their visual appeal and ease of opening. Additionally, there is a rising preference for convenience among consumers, who are seeking packaging that is lightweight, portable, and easy to store. These trends are stimulating innovation in the flexible packaging industry, leading to the introduction of new materials and technologies to meet the changing demands of consumers and markets.

Flexible Packaging Market Restraining Factors:

Several factors can hinder the growth of the flexible packaging market. One significant challenge is the environmental impact associated with flexible packaging materials, especially single-use plastics. This has led to increased regulations and scrutiny aimed at reducing plastic waste. Fluctuating raw material prices can also impact the cost-effectiveness of flexible packaging, affecting manufacturers' profit margins. Additionally, competition from alternative packaging solutions, such as rigid packaging or sustainable options like glass or metal, poses a challenge. Furthermore, the complex nature of recycling flexible packaging materials, due to their multilayered structures, presents a barrier to achieving high recycling rates. These factors, among others, can impede the expansion and progress of the flexible packaging market.

Flexible Packaging Market Opportunities:

The flexible packaging market is ripe with opportunities for expansion and innovation. One promising area is the development of sustainable packaging solutions, including bio-based and recyclable materials, to meet the growing demand for eco-friendly packaging. Another opportunity lies in penetrating emerging markets, where increasing disposable incomes and evolving consumer preferences are creating a greater need for packaged products. Advancements in technology, such as digital printing and smart packaging, also offer avenues for customization and interactive packaging solutions. Furthermore, the rise of e-commerce presents a unique opportunity for the flexible packaging market, as online retailers seek packaging that is not only protective but also cost-effective and visually appealing. These opportunities are poised to drive growth and advancement in the flexible packaging sector in the foreseeable future.

Flexible Packaging Market Segmentation:

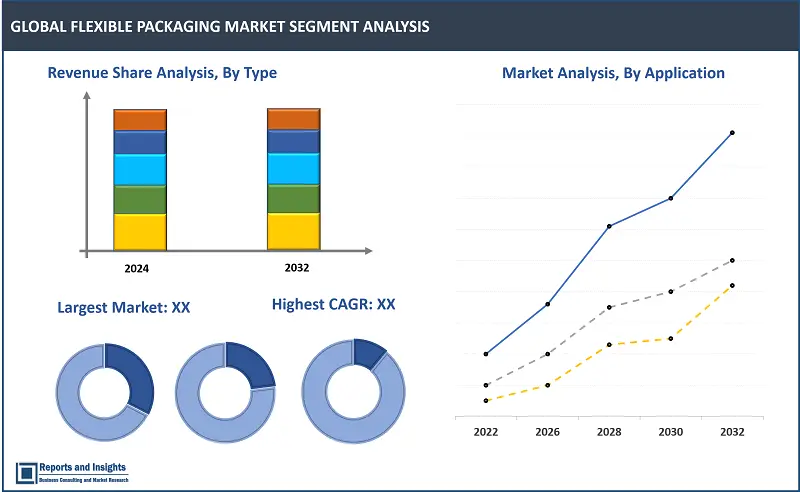

By Type

- Stand-Up Pouches

- Flat Pouches

- Rollstocks

- Gusseted Bags

- Wicketed Bags

- Wraps

- Others

Stand-up pouches are currently the dominant sub-segment in the flexible packaging market. They are preferred for their convenience, light weight, and ability to showcase products attractively on retail shelves. Stand-up pouches offer advantages such as resealability, longer shelf life, and suitability for a wide range of products like food, beverages, and personal care items. Their popularity is driven by consumer demand for convenience and portability, as well as their environmentally friendly features compared to traditional packaging. Therefore, stand-up pouches are expected to maintain their leading position in the flexible packaging market in the foreseeable future.

By Material

- Plastic Films

- Biaxially Oriented Poly Propylene

- Cast Polypropylene

- High-Density Polyethylene

- Low-Density Polyethylene

- Paper

- Aluminum Foil

- Bioplastics

Plastic films currently lead the flexible packaging market. They are popular for their flexibility, durability, and cost-effectiveness. These films provide strong barriers against moisture, oxygen, and light, making them suitable for various products like food, beverages, pharmaceuticals, and personal care items. Additionally, plastic films are lightweight and offer easy customization through printing, allowing for appealing packaging designs. Despite environmental concerns, plastic films remain widely used in flexible packaging due to their functional benefits and affordability.

By Printing Technology

- Flexography

- Rotogravure

- Digital Printing

- Other

Flexography stands out as the leading printing technology in the flexible packaging market. Its popularity is driven by its versatility, cost-effectiveness, and capacity to print on various substrates like film, paper, and foil. Flexographic printing excels in high-volume printing, delivering excellent print quality suitable for vibrant colors and intricate designs. Its quick drying times and high-speed capabilities further enhance its appeal in the flexible packaging sector. While digital printing is emerging for its customization and suitability for short print runs, flexography remains the go-to choose for many manufacturers due to its reliability and cost efficiency, especially for large-scale production

By Application

- Food Beverage

- Healthcare

- Cosmetics Toiletries

- Other Applications

The food and beverage industry stands out as the dominant application segment in the flexible packaging market. This is due to the extensive use of flexible packaging in providing barrier protection, convenience, and visually appealing product presentation. Flexible packaging plays a crucial role in the food industry by extending shelf life, preserving product freshness, and reducing food waste. In the beverage sector, it offers lightweight and easily portable packaging solutions. While flexible packaging also finds wide applications in healthcare, cosmetics, and toiletries, its prevalence in the food and beverage industry is particularly noteworthy due to the sector's high demand for flexible, cost-effective, and sustainable packaging solutions.

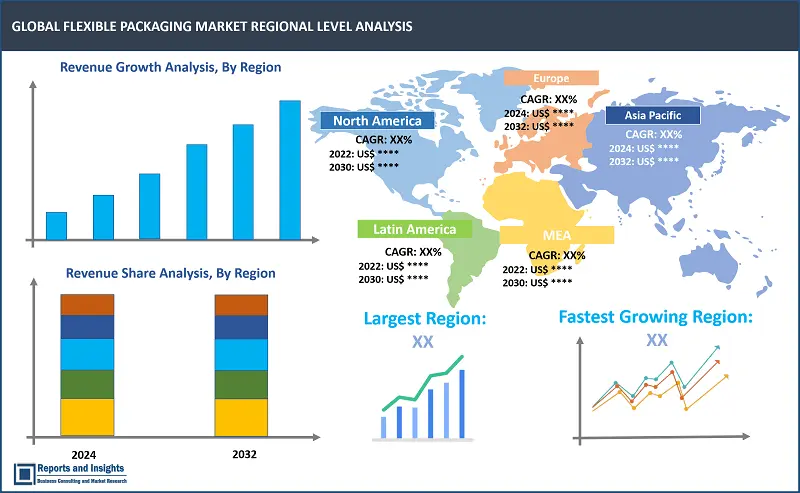

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

The Asia Pacific region is currently the dominant region in the flexible packaging market. This growth is fueled by rapid urbanization, evolving consumer habits, and rising disposable incomes. The food and beverage sector is a major contributor to this trend, alongside healthcare and personal care industries. Moreover, technological advancements and material innovations are further propelling the packaging industry in the region. While North America and Europe remain substantial markets for flexible packaging, it is the Asia Pacific region that leads, driven by its expansive consumer market and flourishing industries.

Leading Flexible Packaging Manufacturers & Competitive Landscape:

The flexible packaging market is highly competitive, with several key players vying for market share and actively engaging in strategic initiatives. These companies focus on product innovation, technological advancements, and expanding their product portfolios to gain a competitive edge. These companies are continuously investing in research and development activities to enhance their product offerings and cater to the evolving needs of customers in terms of efficiency, performance, and sustainability.

These companies include:

- Amcor Limited

- Constantia Flexibles Group GmbH

- Sealed Air Corporation

- Bemis Company, Inc.

- Huhtamäki OYJ

- Coveris Holdings S.A.

- Sonoco Products Company

- Berry Plastics Group, Inc.

- Mondi Group

- Reynolds Group Holdings Limited

- Clondalkin Group Holdings Bv

- Novolex – Carlyle Group

- Bischof + Klein SE & Co. Kg

- British Polythene Industries PLC (RPC BPI Group)

- Proampac

- Britton Group Limited

Flexible Packaging Market Research Scope:

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

4.9% |

|

Segment covered |

Type, material, printing technology, applications and regions. |

|

Regions Covered |

North America: The U.S. Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia New Zealand, ASEAN, Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, Rest of Europe The Middle East Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

North America |

|

Key Players |

Amcor Limited, Constantia Flexibles Group GmbH, Sealed Air Corporation, Bemis Company, Inc., Huhtamäki OYJ, Coveris Holdings S.A., Sonoco Products Company, Berry Plastics Group, Inc., Mondi Group, Reynolds Group Holdings Limited, Clondalkin Group Holdings Bv, Novolex – Carlyle Group, Bischof + Klein SE & Co. Kg, British Polythene Industries PLC (RPC BPI Group), Proampac and Britton Group Limited. |

1. Global Flexible Packaging Market Report Overview

1.1. Introduction

1.2. Report Description

1.3. Methodology

2. Global Flexible Packaging Market Overview

2.1. Introduction

2.1.1. Introduction

2.1.2. Market Taxonomy

2.2. Executive Summary

2.3. Global Flexible Packaging Market Snapshot

2.4. Global Flexible Packaging Market Size and Forecast, 2020–2028

2.4.1. Introduction

2.4.2. Market Value Forecast and Annual Growth Rate (AGR) Comparison (2020–2028)

2.5. Global Flexible Packaging Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.5.4. Trends

2.6. Key Regulations

2.7. Porter’s Five Forces Model

3. Global Flexible Packaging Market, By Type

3.1. Introduction

3.1.1. Annual Growth Rate Comparison, By Type

3.1.2. BPS Analysis, By Type

3.2. Market Revenue (US$Mn) Forecast, By Type

3.2.1. Stand-Up Pouches

3.2.1.1. Standard Stand-Up Pouches

3.2.1.2. Retort Stand-Up Pouches

3.2.2. Flat Pouches

3.2.2.1. Standard Flat Pouches

3.2.2.2. Retort Flat Pouches

3.2.3. Rollstocks

3.2.4. Gusseted Bags

3.2.5. Wicketed Bags

3.2.6. Wraps

3.2.7. Others

3.3. Global Flexible Packaging Market Attractiveness Index, By Type

4. Global Flexible Packaging Market, By Material

4.1. Introduction

4.1.1. Annual Growth Rate Comparison, By Material

4.1.2. BPS Analysis, By Material

4.2. Market Revenue (US$Mn) Forecast, By Material

4.2.1. Plastic Films

4.2.1.1. Polypropylene

4.2.1.1.1. Biaxially Oriented Poly Propylene

4.2.1.1.2. Cast Polypropylene

4.2.1.2. Polyethylene

4.2.1.2.1. High-Density Polyethylene

4.2.1.2.2. Low-Density Polyethylene

4.2.1.3. Poly Vinyl Chloride

4.2.1.4. Biaxiallyoriented Polyethylene Terephthalate

4.2.1.5. Ethylene Vinyl Alcohol

4.2.1.6. Polyamide

4.2.1.7. Polystyrene

4.2.2. Paper

4.2.3. Aluminum Foil

4.2.4. Bioplastics

4.3. Global Flexible Packaging Market Attractiveness Index, By Material

5. Global Flexible Packaging Market, By Printing Technology

5.1. Introduction

5.1.1. Annual Growth Rate Comparison, By Printing Technology

5.1.2. BPS Analysis, By Printing Technology

5.2. Market Revenue (US$Mn) Forecast, By Printing Technology

5.2.1. Flexography

5.2.2. Rotogravure

5.2.3. Digital Printing

5.2.4. Other

5.3. Global Flexible Packaging Market Attractiveness Index, By Printing Technology

6. Global Flexible Packaging Market, By Application

6.1. Introduction

6.1.1. Annual Growth Rate Comparison, By Application

6.1.2. BPS Analysis, By Application

6.2. Market Revenue (US$Mn) Forecast, By Application

6.2.1. Food & Beverage

6.2.2. Healthcare

6.2.3. Cosmetics & Toiletries

6.2.4. Other Applications

6.3. Global Flexible Packaging Market Attractiveness Index, By Application

7. Global Flexible Packaging Market, By Region

7.1. Introduction

7.1.1. Annual Growth Rate Comparison, By Region

7.1.2. BPS Analysis, By Region

7.2. Market Revenue (US$Mn) Forecast, By Region

7.2.1. North America

7.2.2. Latin America

7.2.3. Europe

7.2.4. Asia Pacific

7.2.5. Middle East

7.2.6. Africa

7.3. Global Flexible Packaging Market Attractiveness Index, By Region

8. North America Flexible Packaging Market Analysis and Forecast, 2020–2028

8.1. Introduction

8.1.1. Annual Growth Rate Comparison, By Country

8.1.2. BPS Analysis, By Country

8.2. Flexible Packaging Market (US$Mn) Value Forecast, By Country

8.2.1. U.S. Flexible Packaging Market

8.2.2. Canada Flexible Packaging Market

8.3. North America Flexible Packaging Market, By Type

8.3.1. Stand-Up Pouches

8.3.1.1. Standard Stand-Up Pouches

8.3.1.2. Retort Stand-Up Pouches

8.3.2. Flat Pouches

8.3.2.1. Standard Flat Pouches

8.3.2.2. Retort Flat Pouches

8.3.3. Rollstocks

8.3.4. Gusseted Bags

8.3.5. Wicketed Bags

8.3.6. Wraps

8.3.7. Others

8.4. North America Flexible Packaging Market, By Material

8.4.1. Plastic Films

8.4.1.1. Polypropylene

8.4.1.1.1. Biaxially Oriented Poly Propylene

8.4.1.1.2. Cast Polypropylene

8.4.1.2. Polyethylene

8.4.1.2.1. High-Density Polyethylene

8.4.1.2.2. Low-Density Polyethylene

8.4.2. Poly Vinyl Chloride

8.4.2.1. Biaxiallyoriented Polyethylene Terephthalate

8.4.2.2. Ethylene Vinyl Alcohol

8.4.2.3. Polyamide

8.4.2.4. Polystyrene

8.4.3. Paper

8.4.4. Aluminum Foil

8.4.5. Bioplastics

8.5. North America Flexible Packaging Market, By Printing Technology

8.5.1. Flexography

8.5.2. Rotogravure

8.5.3. Digital Printing

8.5.4. Other

8.6. North America Flexible Packaging Market, By Application

8.6.1. Food & Beverage

8.6.2. Healthcare

8.6.3. Cosmetics & Toiletries

8.6.4. Other Applications

8.7. North America Flexible Packaging Market Attractiveness Index

8.7.1. By Country

8.7.2. By Type

8.7.3. By Material

8.7.4. By Printing Technology

8.7.5. By Application

9. Latin America Flexible Packaging Market Analysis and Forecast, 2020–2028

9.1. Introduction

9.1.1. Annual Growth Rate Comparison, By Country

9.1.2. BPS Analysis, By Country

9.2. Flexible Packaging Market (US$Mn) Value Forecast, By Country

9.2.1. Brazil Flexible Packaging Market

9.2.2. Mexico Flexible Packaging Market

9.2.3. Argentina Flexible Packaging Market

9.2.4. Rest of Latin America Flexible Packaging Market

9.3. Latin America Flexible Packaging Market, By Type

9.3.1. Stand-Up Pouches

9.3.1.1. Standard Stand-Up Pouches

9.3.1.2. Retort Stand-Up Pouches

9.3.2. Flat Pouches

9.3.2.1. Standard Flat Pouches

9.3.2.2. Retort Flat Pouches

9.3.3. Rollstocks

9.3.4. Gusseted Bags

9.3.5. Wicketed Bags

9.3.6. Wraps

9.3.7. Others

9.4. Latin America Flexible Packaging Market, By Material

9.4.1. Plastic Films

9.4.1.1. Polypropylene

9.4.1.1.1. Biaxially Oriented Poly Propylene

9.4.1.1.2. Cast Polypropylene

9.4.1.2. Polyethylene

9.4.1.2.1. High-Density Polyethylene

9.4.1.2.2. Low-Density Polyethylene

9.4.2. Poly Vinyl Chloride

9.4.2.1. Biaxiallyoriented Polyethylene Terephthalate

9.4.2.2. Ethylene Vinyl Alcohol

9.4.2.3. Polyamide

9.4.2.4. Polystyrene

9.4.3. Paper

9.4.4. Aluminum Foil

9.4.5. Bioplastics

9.5. Latin America Flexible Packaging Market, By Printing Technology

9.5.1. Flexography

9.5.2. Rotogravure

9.5.3. Digital Printing

9.5.4. Other

9.6. Latin America Flexible Packaging Market, By Application

9.6.1. Food & Beverage

9.6.2. Healthcare

9.6.3. Cosmetics & Toiletries

9.6.4. Other Applications

9.7. Latin America Flexible Packaging Market Attractiveness Index

9.7.1. By Country

9.7.2. By Type

9.7.3. By Material

9.7.4. By Printing Technology

9.7.5. By Application

10. Europe Flexible Packaging Market Analysis and Forecast, 2020–2028

10.1. Introduction

10.1.1. Annual Growth Rate Comparison, By Country

10.1.2. BPS Analysis, By Country

10.2. Flexible Packaging Market (US$Mn) Value Forecast, By Country

10.2.1. U.K. Flexible Packaging Market

10.2.2. Germany Flexible Packaging Market

10.2.3. Italy Flexible Packaging Market

10.2.4. France Flexible Packaging Market

10.2.5. Spain Flexible Packaging Market

10.2.6. Russia Flexible Packaging Market

10.2.7. Poland Flexible Packaging Market

10.2.8. BENELUX Flexible Packaging Market

10.2.9. NORDIC Flexible Packaging Market

10.2.10. Rest of Europe Flexible Packaging Market

10.3. Europe Flexible Packaging Market, By Type

10.3.1. Stand-Up Pouches

10.3.1.1. Standard Stand-Up Pouches

10.3.1.2. Retort Stand-Up Pouches

10.3.2. Flat Pouches

10.3.2.1. Standard Flat Pouches

10.3.2.2. Retort Flat Pouches

10.3.3. Rollstocks

10.3.4. Gusseted Bags

10.3.5. Wicketed Bags

10.3.6. Wraps

10.3.7. Others

10.4. Europe Flexible Packaging Market, By Material

10.4.1. Plastic Films

10.4.1.1. Polypropylene

10.4.1.1.1. Biaxially Oriented Poly Propylene

10.4.1.1.2. Cast Polypropylene

10.4.1.2. Polyethylene

10.4.1.2.1. High-Density Polyethylene

10.4.1.2.2. Low-Density Polyethylene

10.4.2. Poly Vinyl Chloride

10.4.2.1. Biaxiallyoriented Polyethylene Terephthalate

10.4.2.2. Ethylene Vinyl Alcohol

10.4.2.3. Polyamide

10.4.2.4. Polystyrene

10.4.3. Paper

10.4.4. Aluminum Foil

10.4.5. Bioplastics

10.5. Europe Flexible Packaging Market, By Printing Technology

10.5.1. Flexography

10.5.2. Rotogravure

10.5.3. Digital Printing

10.5.4. Other

10.6. Europe Flexible Packaging Market, By Application

10.6.1. Food & Beverage

10.6.2. Healthcare

10.6.3. Cosmetics & Toiletries

10.6.4. Other Applications

10.7. Europe Flexible Packaging Market Attractiveness Index

10.7.1. By Country

10.7.2. By Type

10.7.3. By Material

10.7.4. By Printing Technology

10.7.5. By Application

11. Asia Pacific Flexible Packaging Market Analysis and Forecast, 2020–2028

11.1. Introduction

11.1.1. Annual Growth Rate Comparison, By Country

11.1.2. BPS Analysis, By Country

11.2. Flexible Packaging Market (US$Mn) Value Forecast, By Country

11.2.1. China Flexible Packaging Market

11.2.2. India Flexible Packaging Market

11.2.3. Japan Flexible Packaging Market

11.2.4. Australia and New Zealand Flexible Packaging Market

11.2.5. South Korea Flexible Packaging Market

11.2.6. ASEAN Flexible Packaging Market

11.2.7. Rest of Asia Pacific Flexible Packaging Market

11.3. Asia Pacific Flexible Packaging Market, By Type

11.3.1. Stand-Up Pouches

11.3.1.1. Standard Stand-Up Pouches

11.3.1.2. Retort Stand-Up Pouches

11.3.2. Flat Pouches

11.3.2.1. Standard Flat Pouches

11.3.2.2. Retort Flat Pouches

11.3.3. Rollstocks

11.3.4. Gusseted Bags

11.3.5. Wicketed Bags

11.3.6. Wraps

11.3.7. Others

11.4. Asia Pacific Flexible Packaging Market, By Material

11.4.1. Plastic Films

11.4.1.1. Polypropylene

11.4.1.1.1. Biaxially Oriented Poly Propylene

11.4.1.1.2. Cast Polypropylene

11.4.1.2. Polyethylene

11.4.1.2.1. High-Density Polyethylene

11.4.1.2.2. Low-Density Polyethylene

11.4.2. Poly Vinyl Chloride

11.4.2.1. Biaxiallyoriented Polyethylene Terephthalate

11.4.2.2. Ethylene Vinyl Alcohol

11.4.2.3. Polyamide

11.4.2.4. Polystyrene

11.4.3. Paper

11.4.4. Aluminum Foil

11.4.5. Bioplastics

11.5. Asia Pacific Flexible Packaging Market, By Printing Technology

11.5.1. Flexography

11.5.2. Rotogravure

11.5.3. Digital Printing

11.5.4. Other

11.6. Asia Pacific Flexible Packaging Market, By Application

11.6.1. Food & Beverage

11.6.2. Healthcare

11.6.3. Cosmetics & Toiletries

11.6.4. Other Applications

11.7. Asia Pacific Flexible Packaging Market Attractiveness Index

11.7.1. By Country

11.7.2. By Type

11.7.3. By Material

11.7.4. By Printing Technology

11.7.5. By Application

12. Middle East Flexible Packaging Market Analysis and Forecast, 2020–2028

12.1. Introduction

12.1.1. Annual Growth Rate Comparison, By Country

12.1.2. BPS Analysis, By Country

12.2. Flexible Packaging Market (US$Mn) Value Forecast, By Country

12.2.1. GCC Countries Flexible Packaging Market

12.2.2. Israel Flexible Packaging Market

12.2.3. Oman Flexible Packaging Market

12.2.4. Rest of Middle East Flexible Packaging Market

12.3. Middle East Flexible Packaging Market, By Type

12.3.1. Stand-Up Pouches

12.3.1.1. Standard Stand-Up Pouches

12.3.1.2. Retort Stand-Up Pouches

12.3.2. Flat Pouches

12.3.2.1. Standard Flat Pouches

12.3.2.2. Retort Flat Pouches

12.3.3. Rollstocks

12.3.4. Gusseted Bags

12.3.5. Wicketed Bags

12.3.6. Wraps

12.3.7. Others

12.4. Middle East Flexible Packaging Market, By Material

12.4.1. Plastic Films

12.4.1.1. Polypropylene

12.4.1.1.1. Biaxially Oriented Poly Propylene

12.4.1.1.2. Cast Polypropylene

12.4.1.2. Polyethylene

12.4.1.2.1. High-Density Polyethylene

12.4.1.2.2. Low-Density Polyethylene

12.4.2. Poly Vinyl Chloride

12.4.2.1. Biaxiallyoriented Polyethylene Terephthalate

12.4.2.2. Ethylene Vinyl Alcohol

12.4.2.3. Polyamide

12.4.2.4. Polystyrene

12.4.3. Paper

12.4.4. Aluminum Foil

12.4.5. Bioplastics

12.5. Middle East Flexible Packaging Market, By Printing Technology

12.5.1. Flexography

12.5.2. Rotogravure

12.5.3. Digital Printing

12.5.4. Other

12.6. Middle East Flexible Packaging Market, By Application

12.6.1. Food & Beverage

12.6.2. Healthcare

12.6.3. Cosmetics & Toiletries

12.6.4. Other Applications

12.7. Middle East Flexible Packaging Market Attractiveness Index

12.7.1. By Country

12.7.2. By Type

12.7.3. By Material

12.7.4. By Printing Technology

12.7.5. By Application

13. Africa Flexible Packaging Market Analysis and Forecast, 2020–2028

13.1. Introduction

13.1.1. Annual Growth Rate Comparison, By Country

13.1.2. BPS Analysis, By Country

13.2. Flexible Packaging Market (US$Mn) Value Forecast, By Country

13.2.1. South Africa Flexible Packaging Market

13.2.2. Egypt Flexible Packaging Market

13.2.3. North Africa Flexible Packaging Market

13.2.4. Rest of Africa Flexible Packaging Market

13.3. Africa Flexible Packaging Market, By Type

13.3.1. Stand-Up Pouches

13.3.1.1. Standard Stand-Up Pouches

13.3.1.2. Retort Stand-Up Pouches

13.3.2. Flat Pouches

13.3.2.1. Standard Flat Pouches

13.3.2.2. Retort Flat Pouches

13.3.3. Rollstocks

13.3.4. Gusseted Bags

13.3.5. Wicketed Bags

13.3.6. Wraps

13.3.7. Others

13.4. Africa Flexible Packaging Market, By Material

13.4.1. Plastic Films

13.4.1.1. Polypropylene

13.4.1.1.1. Biaxially Oriented Poly Propylene

13.4.1.1.2. Cast Polypropylene

13.4.1.2. Polyethylene

13.4.1.2.1. High-Density Polyethylene

13.4.1.2.2. Low-Density Polyethylene

13.4.2. Poly Vinyl Chloride

13.4.2.1. Biaxiallyoriented Polyethylene Terephthalate

13.4.2.2. Ethylene Vinyl Alcohol

13.4.2.3. Polyamide

13.4.2.4. Polystyrene

13.4.3. Paper

13.4.4. Aluminum Foil

13.4.5. Bioplastics

13.5. Africa Flexible Packaging Market, By Printing Technology

13.5.1. Flexography

13.5.2. Rotogravure

13.5.3. Digital Printing

13.5.4. Other

13.6. Africa Flexible Packaging Market, By Application

13.6.1. Food & Beverage

13.6.2. Healthcare

13.6.3. Cosmetics & Toiletries

13.6.4. Other Applications

13.7. Africa Flexible Packaging Market Attractiveness Index

13.7.1. By Country

13.7.2. By Type

13.7.3. By Material

13.7.4. By Printing Technology

13.7.5. By Application

14. Recommendation

14.1. Market Strategy

15. Competitive Landscape

15.1. Competition Dashboard

15.2. List and Company Overview of Global Key Players

15.3. Company Profiles

15.3.1. Amcor Limited

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Key Developments

15.3.1.5. Business Strategies

15.3.2. Constantia Flexibles Group GmbH

15.3.3. Sealed Air Corporation

15.3.4. Bemis Company, Inc.

15.3.5. Huhtamäki OYJ

15.3.6. Coveris Holdings S.A.

15.3.7. Sonoco Products Company

15.3.8. Berry Plastics Group, Inc.

15.3.9. Mondi Group

15.3.10. Reynolds Group Holdings Limited

15.3.11. Clondalkin Group Holdings Bv

15.3.12. Novolex – Carlyle Group

15.3.13. Bischof + Klein SE & Co. Kg

15.3.14. British Polythene Industries PLC (RPC BPI Group)

15.3.15. Proampac

15.3.16. Britton Group Limited

16. Acronyms

Frequently Asked Question

At what CAGR will the flexible packaging market expand?

The market is anticipated to rise at 4.9% through 2032.

What are some key factors driving revenue growth of the flexible packaging market?

Some key factors driving flexible packaging market revenue growth includes consumer preferences, regulatory environment, innovation, cost-effectiveness, and sustainability.

What are some major challenges faced by companies in the flexible packaging market?

Companies face challenges such as supply chain disruptions, consumer preferences, raw material costs, environment concerns, and regulatory compliance.

What types of products are commonly packaged in flexible packaging?

Flexible packaging is used to package a wide range of products, including snacks, beverages, pet food, pharmaceuticals, personal care items, and household products.

How is flexible packaging printed?

Flexible packaging can be printed using various printing technologies, including flexography, rotogravure, and digital printing. Each printing method offers different advantages in terms of print quality, speed, and cost.

Is flexible packaging recyclable?

The recyclability of flexible packaging depends on the materials used. While some flexible packaging materials, such as certain plastics and papers, are recyclable, others may not be. It's essential to check with local recycling facilities for specific guidelines.

How is the competitive landscape in the flexible packaging market?

The market is competitive, with key players focusing on technological advancements, product innovation, and strategic partnerships. Factors such as product quality, reliability, after-sales services, and customization capabilities play a significant role in determining competitiveness.

Who are the leading key players in flexible packaging market?

The leading key players in the flexible packaging market are Amcor Limited, Constantia Flexibles Group GmbH, Sealed Air Corporation, Bemis Company, Inc., Huhtamäki OYJ, Coveris Holdings S.A., Sonoco Products Company, Berry Plastics Group, Inc., Mondi Group, Reynolds Group Holdings Limited, Clondalkin Group Holdings Bv, Novolex – Carlyle Group, Bischof + Klein SE & Co. Kg, British Polythene Industries PLC (RPC BPI Group), Proampac and Britton Group Limited.