Market Overview:

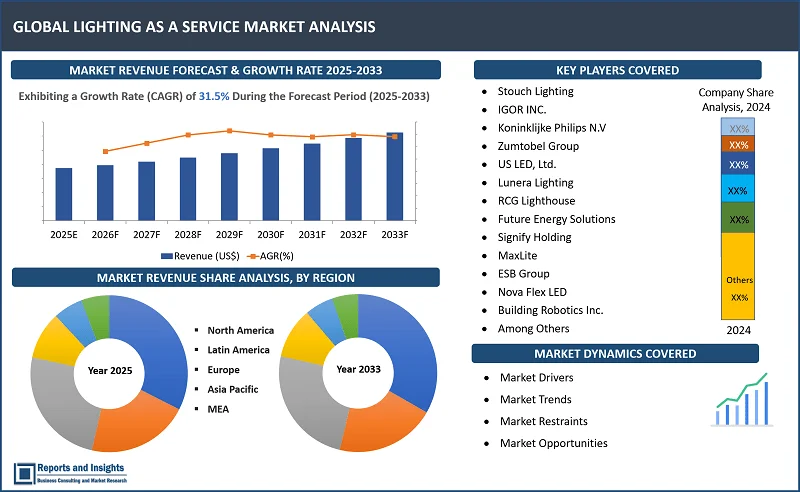

"The global lighting as a service market was valued at US$ 971.9 million in 2024 and is expected to register a CAGR of 31.5% over the forecast period and reach US$ 11,427.6 million in 2033."

|

Report Attributes |

Details |

|

Base Year |

2024 |

|

Forecast Years |

2025-2033 |

|

Historical Years |

2022-2024 |

|

Lighting as a Service Market Growth Rate (2025-2033) |

31.5% |

The global lighting as a service (LaaS) market has been experiencing increasing demand in recent years, as the need for a cheaper and more efficient lighting system is driving businesses. LaaS is an economic model where the usage of light, simulating the purchase of lighting equipment, is sold rather than hardware. This approach provides businesses with access to lighting on a flexible pay-as-you-go basis, where they only pay for how much light they use. Moreover, LaaS enables the company to outsource the maintenance and operation of its lighting equipment to a third-party service provider, enabling the organization to save time and resources that can be utilized in other activities.

Lighting as a Service Market Trends and Drivers

The global lighting-as-a-service (LaaS) market is witnessing robust and sustained growth, driven by an increasing global emphasis on energy efficiency, sustainability, and technological innovation. One of the significant growth trends in the market is the transition from traditional lighting systems to energy-efficient and smart lighting infrastructures. This shift is largely driven by increasing environmental consciousness and the urgent need to reduce greenhouse gas emissions. As lighting represents a substantial portion of electricity consumption in both commercial and residential buildings, businesses and municipalities are under mounting pressure, both from regulatory authorities and from environmentally-conscious consumers to adopt lighting solutions that significantly cut down energy usage and carbon footprints.

In addition, the increasing adoption of LED lighting technology, which consumes significantly less energy than conventional lighting solutions and offers longer operational lifespans. This aligns with broader energy conservation goals and supports international sustainability initiatives. The LaaS model makes it easier for organizations to transition to such advanced lighting technologies by eliminating the need for high upfront capital investments. Instead, users can subscribe to lighting services on a pay-as-you-go or subscription basis, typically aligned with energy consumption levels. This operational expenditure (OpEx)-based model is attractive for organizations looking to modernize infrastructure cost-effectively while benefiting from maintenance and performance guarantees bundled into the service.

Moreover, the integration of smart lighting technologies and IoT (Internet of Things) capabilities within the LaaS framework is significantly driving the market growth. The implementation of connected lighting systems allows for real-time monitoring, automated lighting controls, data analytics, and personalized illumination settings. These features improve energy efficiency and also enable predictive maintenance and operational optimization, contributing to a higher return on investment (ROI). For instance, sensors can detect occupancy and ambient light levels to dynamically adjust lighting, thus conserving energy when full illumination is not required.

Furthermore, the market is gaining momentum due to the rise of smart buildings, smart cities, and electrification trends, including the integration of electric vehicle (EV) infrastructure and renewable energy systems. This urban and technological evolution demands adaptive and scalable lighting solutions that can be synchronized with other intelligent systems, enhancing overall energy management and utility efficiency. As urbanization continues to expand globally, particularly in emerging economies, the demand for flexible, extensible, and intelligent lighting systems grows correspondingly. These factors are collectively shaping a dynamic, subscription-based lighting ecosystem that prioritizes energy efficiency, adaptability, and long-term value, expected to drive the global lighting as a service markеt during the forecast period.

Lighting as a Service Market Restraining Factors

The global lighting as a service (LaaS) market is facing several restraining factors that are limiting the growth of the market. Some of the restraining factors include high initial capital investment, lack of awareness and understanding about the LaaS business model, lack of standardized solutions, and the absence of clear regulations. In addition, the high cost of the initial infrastructure and the lack of standard data formats are also restraining the growth of the market. Furthermore, lack of knowledge and lack of trust between consumers and service providers, lack of technical support infrastructure, and high costs involved are some of the restraining factors, which are expected to limit the lighting as a service markеt growth during the forecast period.

Lighting as a Service Market Opportunities

The Global Lighting-as-a-Service (LaaS) market is seeing significant growth opportunities due to several key factors, including energy efficiency regulations, sustainability-focused investments, and the growing need for retrofitting aging infrastructure. The energy efficiency regulations play a crucial role in accelerating the adoption of LaaS solutions. Governments around the world are implementing stricter energy-saving policies, setting higher standards for lighting systems in both commercial and residential sectors. These regulations aim to reduce electricity consumption and greenhouse gas emissions, making energy-efficient lighting solutions more attractive. Since lighting accounts for a large portion of energy use in buildings, businesses, and municipalities are under pressure to replace traditional, energy-hungry lighting systems with more efficient alternatives, such as LED technology and smart lighting solutions. LaaS offers a convenient way to comply with these regulations without the need for heavy upfront investment, as customers can pay for lighting services based on their energy usage, reducing costs while meeting regulatory requirements.

In addition, sustainability-focused investments are the major driving factor of growth in the LaaS market. With increasing global awareness of climate change and environmental challenges, businesses and governments are prioritizing sustainability in their operations and investments. Companies are more inclined to adopt solutions that align with their environmental goals, including reducing energy consumption, lowering carbon footprints, and embracing renewable energy sources. Lighting, being a key component of energy usage, presents an easy and effective way to make substantial environmental improvements. LaaS offers a flexible, cost-effective solution that helps organizations achieve sustainability goals while providing a modern, energy-efficient lighting system that is continually maintained and upgraded.

Moreover, the need for retrofitting aging infrastructure presents a significant opportunity for the LaaS market. Many buildings and public spaces rely on outdated, inefficient lighting systems that consume excessive energy and require costly maintenance. Retrofitting these buildings with advanced, energy-efficient lighting solutions is becoming increasingly important to reduce operating costs and improve energy efficiency. However, many organizations face budget constraints when it comes to large capital investments in new infrastructure. LaaS provides a solution by allowing businesses to upgrade their lighting without large upfront expenses. This model includes installation, maintenance, and even monitoring services, making it easier for businesses to modernize their lighting systems without the financial burden of a traditional upgrade.

Lighting as a Service Market Segmentation

By Service Type

- Design and Consulting

- Installation and Integration

- Maintenance and Operation

- Managed Services

- Energy Optimization

- Others

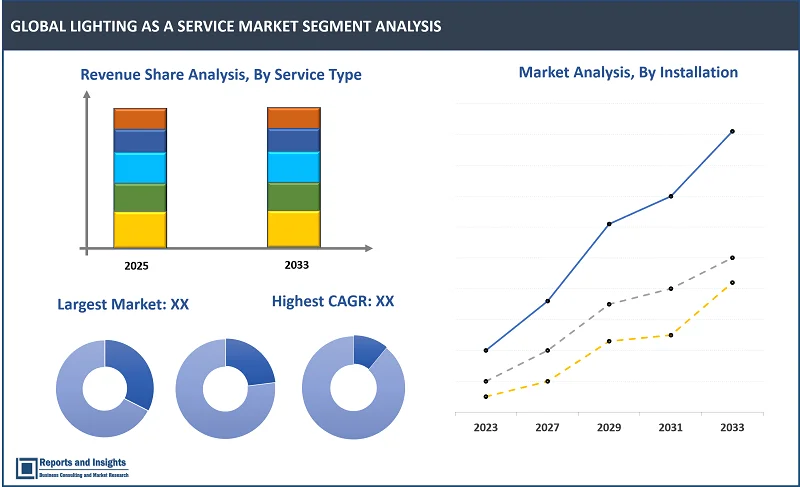

The installation and integration segment among the service type segment is expected to account for the largest revenue share in the global lighting as a service market. This segment involves the initial installation, connecting the lighting system to the internet network, and integrating the system with building management systems (BMS). Installation and integration are crucial for LaaS as it allows the lighting system to integrate with other building systems, such as HVAC or security, to optimize energy consumption and user experience within the facility.

By Lighting Type

- LED Lighting

- Fluorescent Lighting

- High-Intensity Discharge (HID) Lighting

- Incandescent Lighting

- Others (CFL, Halogen, etc.)

Among the lighting type segments, the LED lighting segment is expected to account for the largest revenue share in the global lighting as a service market. This dominance is primarily attributed to the superiority of LED lighting over other lighting options, such as incandescent, fluorescent, and halogen bulbs. While LED lighting is initially more expensive, the benefits of LED lights make up for the extra cost. LED lights are more energy efficient, produce less heat, have a longer lifespan, and emit less light in all directions as compared to other lighting options.

By Component

- Luminaries and Fixtures

- Lighting Controls

- Sensors

- Dimmers

- Daylight Harvesting

- Smart Lighting Systems

- Software and Communication Systems

- Software

- Lighting Management Software

- Energy Monitoring Software

- Services

- Installation Services

- Maintenance Services

The component segment among the luminaries and fixtures segment is expected to account for the largest revenue share in the global lighting as a service market. This can be attributed to the increasing demand for LED technology, as LED lights offer superior energy efficiency and longevity over traditional lighting options. Additionally, the integration of sensors and control systems within light fixtures is contributing to the growth of the component segment, as they enable increased energy efficiency and automation capabilities.

By Installation

- Retrofit Installation

- New Installation

Among the installation segments, the new installation segment is expected to account for the largest revenue share in the global lighting as a service market. This is attributed to the high demand for lighting components, which are essential for the installation of new lighting systems. In addition, the component segment is also driven by the continuous technological advancements in lighting fixtures, sensors, and controls, which are used in various lighting services segments. This is leading to the increasing adoption of advanced lighting components by businesses, which in turn is driving the growth of the component segment.

By End Use

- Commercial

- Industrial

- Municipal/Public

- Residential

- Hospitals & Clinics

- Schools & Universities

- Hotels & Restaurants

- Transportation

- Others

The residential segment is expected to account for the largest revenue share among the end-user segments, drivеn by thе growing number of homeowners and consumers investing in energy-efficient and cost-effective lighting solutions. The growing awareness about rising electricity bills and energy conservation is leading to the growth of the segment. The residential segment is dominating the market due to the increased adoption of LED light fixtures in homes, which is being driven by the increasing cost of conventional lighting options. Furthermore, the segment is also driven by the advantages of energy-saving lighting solutions, such as longer life, higher efficiency, lower power consumption, and zero mercury.

Lighting as a Service Market, By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

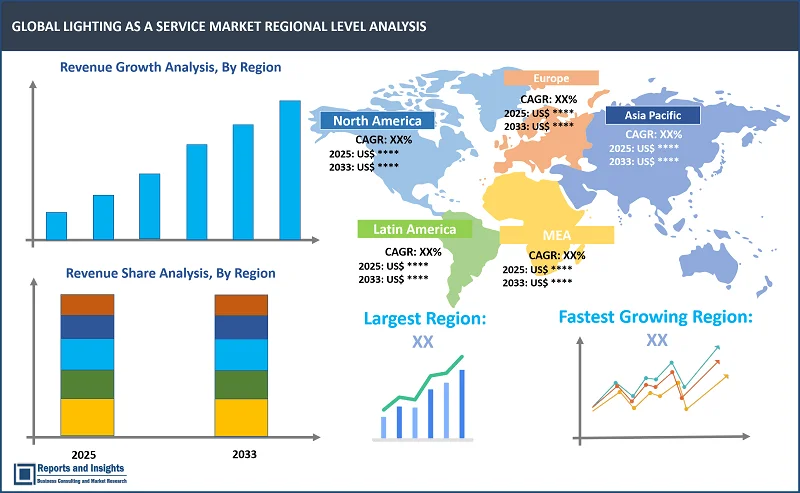

The global lighting as a service market is divided into five key regions: North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Market scenarios vary significantly due to differences in demand, supply, adoption rates, preferences, applications, and costs across the regional markets. Among these regional markets, North America leads in terms of revenue share, demand, and production volume, driven by major economies such as the U.S. and Canada. This is attributed to the presence of sophisticated infrastructure and advanced technology in the region, as well as favorable government regulations and increasing awareness of energy efficiency, which has created a favorable environment for the market. As a result, the region has emerged as the dominant player in the lighting as a service market, accounting for the largest share of the market.

Leading Companies in Lighting as a Service Market & Competitive Landscape:

The competitive landscape in the global lighting as a service market is characterized by intense competition among leading manufacturers seeking to leverage maximum market share. Major companies are focused on innovation, and differentiation, and compete on factors such as product quality, technological advancements, and cost-effectiveness to meet the evolving demands of consumers across various sectors. Some key strategies adopted by leading companies include investing significantly in research and development (R&D) to create advanced technologies. The companies follow strategies such as partnerships, collaborations, and mergers to capture a larger share of the market.

These companies include:

- Stouch Lighting

- IGOR INC.

- Koninklijke Philips N.V

- Zumtobel Group

- US LED, Ltd.

- Lunera Lighting

- RCG Lighthouse

- Future Energy Solutions

- Signify Holding

- MaxLite

- ESB Group

- Nova Flex LED

- Building Robotics Inc.

- Journey Energy Solutions Limited

- Southpoint Solutions

- TellCo Europe Sagl

- Digital Lumens Inc.

- Urban Volt

- Deutsche Lichtmiete AG

- OSRAM GmbH

- Others

Recent Developments:

-

March 2025: SUSI Partners, a leading financial institution in the field of sustainable infrastructure, has recently renewed its partnership with a prominent energy service provider in Germany to continue funding industrial lighting-as-a-service (LaaS) ventures. This extended collaboration aims to strengthen the use of smart and eco-friendly lighting solutions, offering businesses access to energy-efficient lighting systems by employing the LaaS model, where subscribers pay a monthly fee to cover the cost of the system, without requiring any upfront investment.

Lighting as a Service Market Research Scope

|

Report Metric |

Report Details |

|

Lighting as a Service Market size available for the years |

2022-2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2033 |

|

Compound Annual Growth Rate (CAGR) |

31.5% |

|

Segment covered |

By Service Type, Lighting Type, Component, Installation, and End Use |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, the Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

North America |

|

Key Players |

Stouch Lighting, IGOR INC., Koninklijke Philips N.V, Zumtobel Group, US LED, Ltd., Lunera Lighting, RCG Lighthouse, Future Energy Solutions, Signify Holding, MaxLite, ESB Group, Nova Flex LED, Building Robotics Inc., Journey Energy Solutions Limited, Southpoint Solutions, TellCo Europe Sagl, Digital Lumens Inc., Urban Volt, Deutsche Lichtmiete AG, OSRAM GmbH, and Others. |

Frequently Asked Question

What is the size of the global lighting as a service market in 2024?

The global lighting as a service market size reached US$ 971.9 million in 2024.

At what CAGR will the global lighting as a service market expand?

The global market is expected to register a 31.5% CAGR through 2025-2033.

How big can the global lighting as a service market be by 2033?

The market is estimated to reach US$ 11,427.6 Million by 2033.

What are some key factors driving revenue growth in the lighting as a service market?

Key factors driving revenue growth in the lighting as a service market include Energy efficiency improvements, Cost savings potential, Smart lighting integration.

What are some major challenges faced by companies in the lighting as a service market?

Companies in the lighting as a service market face challenges such as dumping of low-quality lighting products in the market, lack of expertise in new technology.

How is the competitive landscape in the lighting as a service market?

The competitive landscape in the lighting as a service market is marked by intense rivalry among leading manufacturers. Companies compete on product quality, technological innovation, and cost-effectiveness. To maintain their market position, leading firms invest in research, and development, form strategic partnerships, explore sustainable practices to differentiate themselves, and meet evolving consumer demands.

How is the global lighting as a service market report segmented?

The global lighting as a service market report segmentation is based on service type, lighting type, component, installation, end use, and region.

Who are the key players in the global lighting as a service market report?

Key players in the global lighting as a service market report include Stouch Lighting, IGOR INC., Koninklijke Philips N.V, Zumtobel Group, US LED, Ltd., Lunera Lighting, RCG Lighthouse, Future Energy Solutions, Signify Holding, MaxLite, ESB Group, Nova Flex LED, Building Robotics Inc., Journey Energy Solutions Limited, Southpoint Solutions, TellCo Europe Sagl, Digital Lumens Inc., Urban Volt, Deutsche Lichtmiete AG, OSRAM GmbH, and Others.